Brent Odom Death: Is The Reign Of Crude Oil Ending?

Imagine a world where the very foundation of global energy, the mighty Brent crude oil, faces its ultimate challenge. This isn't just about daily price swings; it's about a much bigger picture, a potential "Brent Odom death" scenario for the commodity that has shaped economies and influenced nations for decades. It's a rather thought-provoking idea, isn't it, especially when you consider how deeply this particular oil benchmark is woven into the fabric of international trade and investment.

For so long, Brent crude oil has stood as a major benchmark price for purchases of oil worldwide. It's more than just a type of oil; it’s a vital pulse for the global economy. Oil production from Europe, Africa, and the Middle East, flowing west, tends to be priced relative to this key benchmark, which is sourced from the North Sea. So, when we talk about a "Brent Odom death," we're really looking at what might happen if this essential benchmark were to lose its pivotal role, or if its value were to diminish significantly.

This article will explore the profound importance of Brent crude oil in today's market, drawing on how live oil market prices are determined and tracked. We will then consider the intriguing, perhaps even unsettling, concept of its "death"—what that could truly mean for global trade, energy security, and your own investments. It’s a pretty compelling topic, actually, for anyone who follows energy news or has an interest in the big shifts happening across the globe.

Table of Contents

- The Unquestionable Dominance of Brent Crude Today

- What a "Brent Odom Death" Might Truly Signify

- Key Factors Shaping Brent Crude's Future

- Tracking the Pulse: How to Monitor Brent's Health

- Questions People Are Asking About Oil's Future

- Looking Ahead: The Evolving Story of Brent Crude

The Unquestionable Dominance of Brent Crude Today

To truly grasp the idea of a "Brent Odom death," we first need to appreciate just how incredibly alive and influential Brent crude oil is right now. It's not just a name; it’s the standard against which so much of the world's oil is measured. You can, for instance, gain instant access to the live Brent crude oil price, along with key market metrics, trading details, and even intricate futures contract specifications. This kind of transparency, you know, is pretty vital for market participants.

This benchmark, sourced from the North Sea, plays a huge part in pricing oil from places like Europe, Africa, and the Middle East. It’s like a central pillar. Our platform, for example, helps you get all information on the price of oil, including news, charts, and real-time quotes. This helps anyone involved, from big traders to casual observers, keep a very close eye on things. We even track key benchmarks and production flows from major suppliers, including OPEC members, the United States, and global trading hubs. That’s how important this oil is.

With global crude oil trade valued at over $3 trillion annually, having a clear picture of Brent crude oil live charts, intraday and historical charts, is absolutely essential. We also offer insights into Brent crude oil buy and sell signals, news, videos, and historical data, including averages and returns. This gives you a really comprehensive view, actually, of how this market works. You can view live updates and historical trends for the Brent crude oil spot price, which is quite helpful for making sense of its movements.

Understanding how live oil market prices are determined is a big part of what we offer. It's not just a random number; there's a whole system behind it. You can, for example, track key economic indicators and market insights with interactive data. This helps paint a complete picture of the forces at play. Welcome to browse the page of Brent crude price chart, which shows the current Brent crude oil price and its fluctuation width, previous close price, and open price, among other things. It's a rather detailed look at its daily life, if you will.

So, when you consider all of this—the sheer volume of trade, the reliance of so many regions on its pricing, and the depth of information available—it becomes very clear that Brent crude oil is, today, a truly dominant force. It’s not just a commodity; it’s a global economic indicator, and its movements are watched with great care by countless individuals and organizations. This is why the idea of a "Brent Odom death" is such a compelling, almost dramatic, concept to explore.

What a "Brent Odom Death" Might Truly Signify

If we talk about a "Brent Odom death," it's certainly not about the physical disappearance of oil from the North Sea, but rather a profound shift in its market standing or influence. This metaphorical "death" could manifest in several ways, each with significant implications. For instance, it could mean a drastic reduction in its global demand, perhaps due to a widespread adoption of alternative energy sources. That's a pretty big change to consider, isn't it?

Another scenario might involve a loss of its benchmark status. What if new, more relevant oil grades emerge, or if regional markets become so self-sufficient that a global benchmark like Brent becomes less critical? This would, in a way, diminish its universal pricing power. The global crude oil trade, currently valued at over $3 trillion, relies heavily on this benchmark for clarity. If that clarity were to fade, the entire system would need to adapt, which could be quite a challenge.

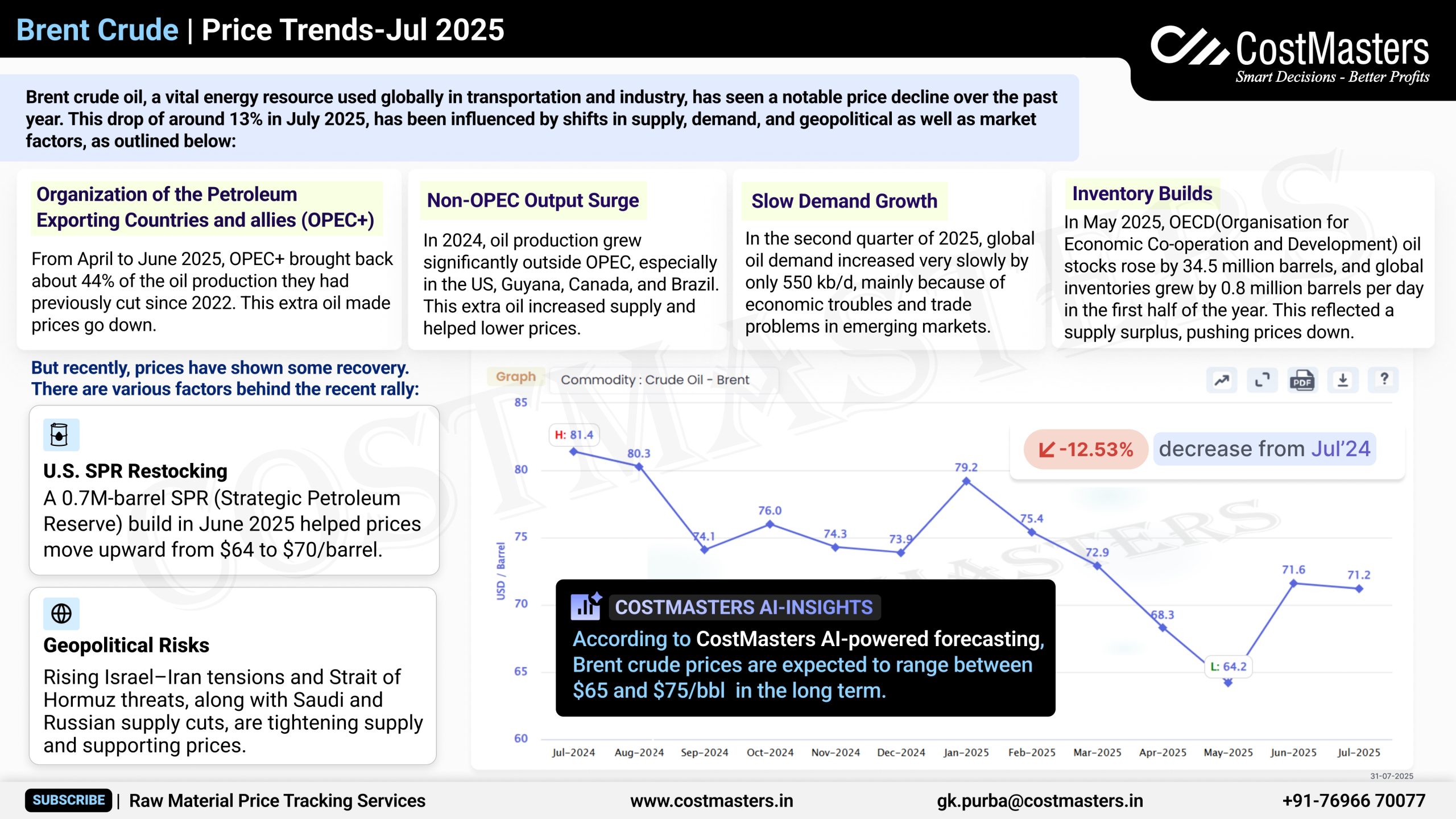

A "death" could also imply a sustained period of extremely low prices, making extraction and trading unprofitable for many. While Brent crude oil averages, returns, and historical data show its resilience over time, a prolonged economic downturn or an overwhelming supply glut could certainly test its limits. It’s not just about a temporary dip; we're talking about a fundamental shift in its economic viability. This is where tracking things like oil price charts for Brent crude, WTI, and oil futures becomes incredibly important, as they tell a story about market health.

The transition away from fossil fuels, driven by climate concerns and technological advancements, presents a very real, long-term threat to oil demand. As countries invest more in renewables and electric vehicles, the need for crude oil, including Brent, could gradually decrease. This isn't an overnight process, of course, but it’s a trend that could, in time, lead to a significant decline in Brent’s overall importance. It’s a slow erosion rather than a sudden collapse, more or less.

Consider, too, the impact of geopolitical shifts. If major producing regions were to significantly alter their trading relationships or if new, dominant suppliers emerged outside the traditional Brent-influenced areas, this could also chip away at its global relevance. The interconnectedness of energy news covering oil, petroleum, natural gas, and investment advice means that any major geopolitical event can send ripples through the market, potentially accelerating a decline. It’s a very sensitive balance, you know.

So, while the idea of a "Brent Odom death" sounds dramatic, it really speaks to the potential for fundamental, long-term changes in the global energy landscape. It’s about the benchmark’s role evolving, or perhaps even diminishing, in the face of new realities. This isn't just an academic exercise; it has very real implications for economies, industries, and indeed, for everyone who relies on energy. It’s something worth watching closely, I think.

Key Factors Shaping Brent Crude's Future

The future of Brent crude oil, and whether it faces a metaphorical "death," hinges on a variety of complex factors. One major element is the pace of the global energy transition. As more nations commit to reducing carbon emissions, the push for renewable energy sources like solar and wind power, along with the adoption of electric vehicles, will directly impact oil demand. This shift, you see, is a powerful force that could reshape the entire energy sector.

Technological advancements also play a significant role. Breakthroughs in battery storage, more efficient renewable energy generation, or even new methods for carbon capture could lessen the world's reliance on crude oil. While Brent crude oil price information, historical data, charts, and stats show its enduring value, future innovations could certainly disrupt that pattern. It's almost like a race against time for traditional energy sources, in a way.

The decisions made by major suppliers, especially OPEC members, continue to be very influential. Their collective production policies can significantly affect global supply and, consequently, prices. If OPEC+ decides to maintain high production levels in a world of declining demand, it could certainly contribute to a downward pressure on Brent's value. We track key benchmarks and production flows from these major suppliers, and their actions can tell you a lot about the market's direction, truly.

Global economic health is another critical factor. A robust global economy typically means higher demand for oil for transportation, manufacturing, and other industrial activities. Conversely, a prolonged economic slowdown or recession could drastically reduce oil consumption, pushing prices down and challenging Brent's stability. The clarity needed to navigate global crude oil trade, valued at over $3 trillion, becomes even more important during these uncertain times, you know.

Furthermore, geopolitical stability, or the lack thereof, can dramatically impact oil markets. Conflicts, trade disputes, or political unrest in major oil-producing regions can disrupt supply chains, leading to price volatility. While such events can sometimes temporarily boost prices, sustained instability could also deter long-term investment in oil infrastructure, gradually shifting focus to more stable energy sources. It’s a pretty delicate balance, if you think about it.

Ultimately, the story of Brent crude oil is intertwined with global economics, politics, and environmental goals. Its future isn't set in stone, and these various forces are constantly at play, shaping its path. Understanding these dynamics is key to anticipating any potential "Brent Odom death" scenario and its broader implications. It’s a rather fascinating, if sometimes worrying, area to observe.

Tracking the Pulse: How to Monitor Brent's Health

Given the potential for significant shifts, keeping a close eye on Brent crude oil's health is incredibly important for anyone interested in global markets. Our platform, for instance, offers instant access to the live Brent crude oil price, which is a fundamental starting point. Knowing the real-time quote allows you to grasp the immediate market sentiment, which is pretty vital for making quick decisions, you know.

Beyond the live price, delving into the Brent crude oil live chart, including intraday and historical charts, provides a much deeper understanding. These charts illustrate trends, patterns, and past price movements, helping you spot potential shifts before they become major events. You can also view live updates and historical trends for the Brent crude oil spot price, which is another useful tool for analysis. It’s like getting a detailed medical report for the market, in a way.

It's also very helpful to pay attention to key market metrics and trading details. Understanding things like futures contract specifications can give you insights into market expectations for future prices. We provide all information on the price of oil, including news and charts, so you can piece together the bigger picture. This helps you move beyond just the daily numbers and see the underlying forces at work, you know.

Keeping up with energy news covering oil, petroleum, natural gas, and investment advice is absolutely essential. News events—whether they are geopolitical developments, economic reports, or technological breakthroughs—can have an immediate and lasting impact on oil prices. Our platform offers Brent crude oil buy and sell signals and news and videos, which can help you stay informed and react quickly. It's like having a constant stream of vital updates, basically.

Furthermore, tracking key economic indicators and market insights with interactive data can provide valuable context. Things like global GDP growth, inflation rates, and industrial production figures all influence oil demand. By understanding how live oil market prices are determined, and then cross-referencing that with broader economic data, you get a much more complete and nuanced view. It’s a rather comprehensive approach to market analysis, I think.

Ultimately, monitoring Brent crude oil is about much more than just watching a number go up or down. It's about understanding the complex interplay of supply, demand, geopolitics, and technological progress. By utilizing the available tools and information, you can stay informed about its current status and better anticipate any future "Brent Odom death" scenarios or significant market shifts. It’s a continuous learning process, truly.

Questions People Are Asking About Oil's Future

Here are some common questions that pop up when people think about the future of oil, especially in the context of a potential "Brent Odom death" or significant market change:

What would cause Brent crude oil prices to drop significantly?

A major drop in Brent crude oil prices could stem from several factors. A global economic recession, for example, would drastically reduce demand for energy across industries and transportation. An unexpected surge in supply from major producers, or a breakthrough in alternative energy technologies that rapidly replaces oil, could also cause a significant price decline. It’s a rather delicate balance between supply and demand, you know, and any major shift can have a big impact.

Is renewable energy a threat to Brent crude's dominance?

Absolutely, renewable energy sources like solar, wind, and hydropower pose a long-term threat to Brent crude's dominance. As these technologies become more efficient and affordable, and as governments push for decarbonization, the world's reliance on fossil fuels will gradually lessen. This transition isn't immediate, but over time, it could significantly reduce the demand for crude oil, potentially leading to a diminished role for Brent as a benchmark. It's a slow but steady change, you might say.

How does geopolitical instability affect Brent crude's future?

Geopolitical instability can have a profound, sometimes immediate, impact on Brent crude's future. Conflicts in oil-producing regions can disrupt supply, leading to price spikes. However, sustained instability or a shift in global alliances could also lead countries to seek more stable, diverse energy sources, potentially reducing long-term demand for oil from volatile regions. This could, in turn, lessen the overall importance of benchmarks like Brent. It’s a very complex web of factors, truly.

Looking Ahead: The Evolving Story of Brent Crude

We’ve explored the significant role Brent crude oil plays in the global economy, acting as a crucial benchmark for oil prices worldwide. We've also considered the intriguing, perhaps even unsettling, concept of a "Brent Odom death"—not a literal end, but a metaphorical decline in its dominance or influence, driven by shifts in demand, technology, and global dynamics. It’s a pretty big topic, you know, with lots of moving parts.

From tracking live prices and historical charts to understanding the intricate details of futures contracts and the broader energy news landscape, staying informed is key. The forces shaping Brent's future are complex and interconnected, ranging from the rapid advancements in renewable energy to the strategic decisions of major oil producers like OPEC members and the United States. You can learn more about energy market trends on our site, which offers a lot of useful information.

As the world moves towards a more sustainable energy future, the story of Brent crude oil is continuously evolving. Its journey is certainly one to watch, as its shifts will undoubtedly ripple through global markets and economies. To keep up with the latest insights and analysis, you might want to check out a recent market analysis from a leading energy agency, which often provides valuable perspectives on these ongoing transformations. We also have more details on global oil trade available here, which might be helpful.

- Mark Fuhrman Home

- How Much Older Is Jeffrey Dean Morgan Than Jensen Ackles

- Jeweled Leather Dog Collars

- Queens 4 Legends 1 Stage Tour

- Jane Austen Set Of Books

Brent Spiner | ScreenRant

Brent Crude | Price Trends — CostMasters

Los Angeles, USA. 01st Feb, 2024. Brent Smith attends the 2024 Warner